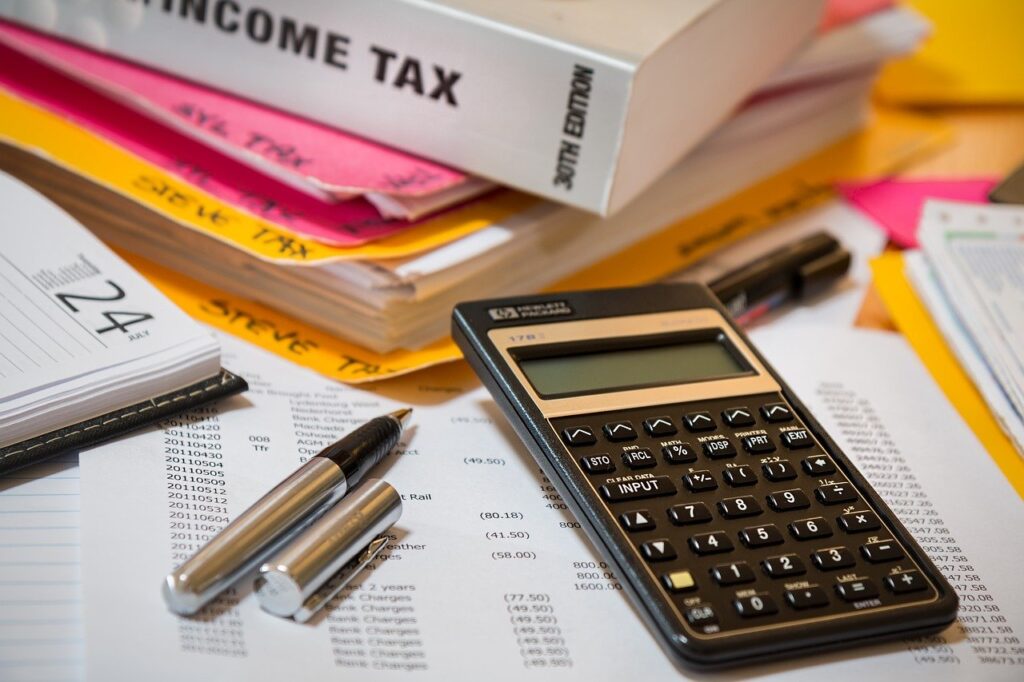

Kenya Bankers Association protests 16% VAT on financial transactions in Finance Bill 2024

The Finance Bill 2024 has ignited heated debates across Kenya due to its proposal to introduce a 16% Value Added Tax (VAT) on various financial transactions. This move, if implemented, could have far-reaching implications for consumers, businesses, and the overall economy.

Understanding the Proposed VAT Changes

- Scope of VAT:

- The Finance Bill aims to extend VAT to several financial services, including:

- Issuing credit and debit cards

- Telegraphic money transfers

- Foreign exchange transactions

- Cheque handling.

- Previously, these services were exempt from VAT.

- The Finance Bill aims to extend VAT to several financial services, including:

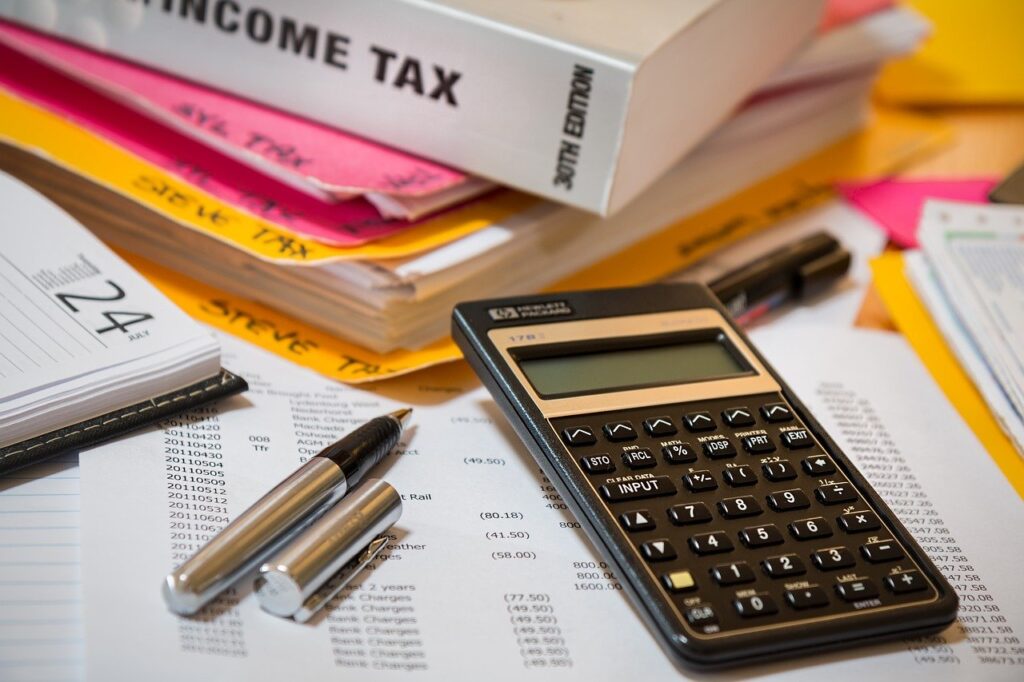

- Consumer Impact:

- The proposed VAT could significantly increase the cost of banking for consumers. Imagine paying an additional 16% when you transfer money or use your debit card.

- Low-income individuals and small businesses would be disproportionately affected.

- Bankers’ Concerns:

- The Kenya Bankers Association (KBA) has raised serious concerns about this move. They argue that bank charges are fundamentally different from direct payments for goods and services.

- Banks do not physically deliver goods; therefore, treating bank charges as VATable may not be appropriate.

- Tax Burden on Financial Services:

- If the proposed VAT is implemented, the total tax burden on financial services could soar to 40%. This includes the existing Excise Duty.

- KBA warns that such high taxation could hinder economic growth by taxing export proceeds and affecting the competitiveness of Kenyan products.

The Debate Continues

- Economic Implications:

- Proponents argue that expanding the tax base is necessary for revenue generation. Kenya faces fiscal challenges, and the government needs funds to provide essential services.

- Critics, however, fear that taxing financial services excessively could stifle economic activity and discourage investment.

- Alternatives to VAT:

- KBA invites the government and the National Assembly to explore alternative revenue-raising measures. These should strike a balance between revenue collection and economic growth.

- Perhaps a more targeted approach, such as taxing luxury goods or high-value transactions, could achieve the desired results without burdening everyday banking services.

- Public Perception:

- Public opinion remains divided. Some see the proposed VAT as a necessary evil, while others view it as an unjust burden.

- Transparency and clear communication from policymakers are crucial to address public concerns.

While the proposed 16% VAT on financial transactions in Kenya aims to cover a wide range of services, there are some notable exemptions. These include:

- Interest Income:

- Interest earned on savings accounts, fixed deposits, and other financial instruments is typically exempt from VAT.

- Insurance Premiums:

- Insurance services, including life insurance, health insurance, and property insurance, are often exempt from VAT.

- Loan Transactions:

- Loans and credit facilities provided by financial institutions are generally not subject to VAT.

- Securities Trading:

- Trading in securities such as stocks, bonds, and government securities is usually exempt.

- Foreign Exchange Transactions for Exporters:

- VAT may not apply to foreign exchange transactions related to export proceeds.

Conclusion

The Finance Bill 2024’s proposal to introduce a 16% VAT on financial transactions has sparked intense discussions. While revenue collection is essential, policymakers must carefully consider the impact on consumers, businesses, and Kenya’s economic stability. Collaborative dialogue and thoughtful alternatives can lead to a balanced solution that benefits everyone.

In summary, the Finance Bill 2024’s VAT proposal is a contentious issue, and its implementation will shape Kenya’s financial landscape. As citizens, we must stay informed and engage in constructive conversations about our country’s economic policies.