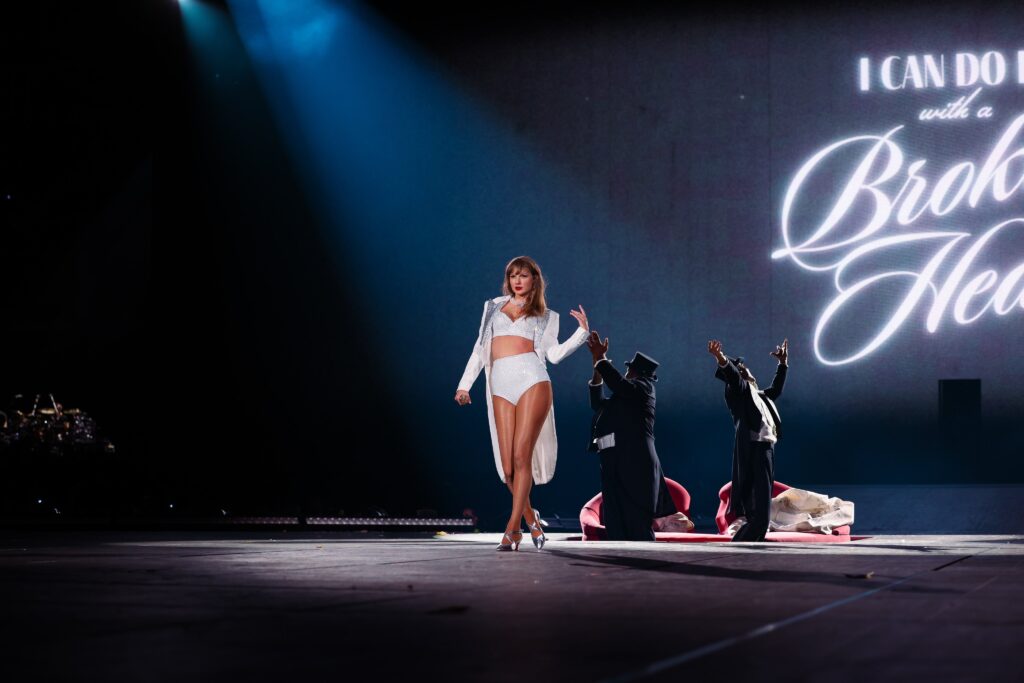

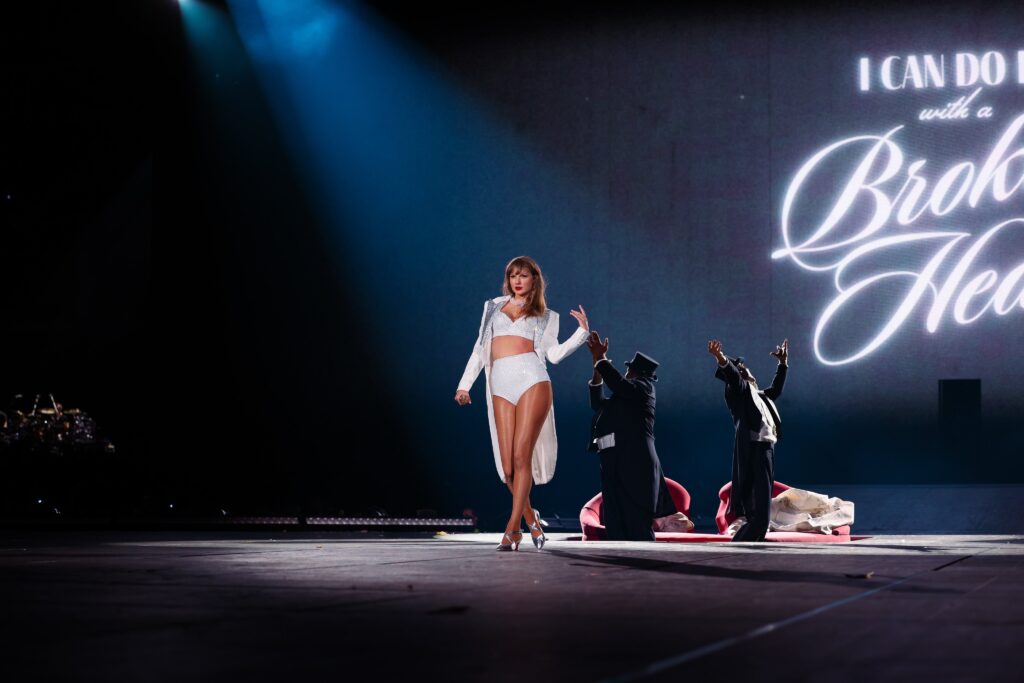

Fake Olympics and Taylor Swift tickets are the two biggest online scams consumers are likely to encounter this year, UK Finance has warned.

The alert came as the banking lobby group reported that the number of people tricked by romance fraud and purchase scams jumped to new highs last year.

Overall, criminals stole £1.17bn in 2023, down 4% from 2022, according to the group’s annual report on fraud.

But UK Finance said the abuse of online platforms continued to leave people vulnerable. It called on tech companies to do more to help stop the scams.

Consumers lost £86m last year to purchase scams, in which they agreed to pay for something that never materialised, UK Finance said.

That was up 28% from 2022. In total, there were more than 156,000 cases of such fraud last year.

“Every year we see a cycle of scams changing throughout the year,” said Ben Donaldson, the managing director of economic crime at UK Finance.

“Olympics and Taylor Swift are the two biggest examples of this year.”

In April, Lloyds Bank revealed that Swift’s fans had lost a total of £1m in scam ticket sales ahead of the UK leg of her tour, which starts in July.

Over 600 of the bank’s customers came forward to report losing money.

UK Finance said fraudsters often convinced victims to pay for goods via bank transfer instead of on an official site.

“Tickets for big events such as the Olympics, Euro 2024, Glastonbury or Taylor Swift sell out quickly and people often look online for better offers to avoid missing out.

“Criminals will use this as an opportunity to try and trick you into purchasing tickets that are either fraudulent or don’t exist, ” UK Finance’s Andy McDonald warned.

The annual report from UK Finance found some progress in the fight against fraud, which is the most common crime in the UK and increased during the pandemic.

It said the total number of cases dipped 1% from 2022, to roughly 2.97 million, with fraud involving payment cards accounting for the vast majority.

The report found losses due to unauthorised transactions fell 3% to £708.7m last year, a drop it said was due to improved customer verification practices.

UK Finance said there was also less money lost to scams in which payments were authorised.

Such losses declined 5% to £459.7m, as cases involving criminals pretending to be a bank or police dropped sharply.

However, the number of victims and money stolen in romance scams, in which people are tricked into believing they are in a relationship, hit a record last year, according to the report.

Losses in these cases were up 17% to £36m and involved an average of 10 payments per case.

This loss is twice the amount reported for the same type of scams in 2020.

“The money stolen funds serious organised crime and victims often suffer emotional damage as fraud is a pernicious and manipulative crime,” Mr Donaldson said.

New regulations are set to come into force on 7 October this year, which will mean UK payment service providers must reimburse customers who fall victim to payment fraud. But there are some exceptions to this rule.

UK Finance said the change added urgency to the fight against fraud.

“With reimbursement rules set to change, we risk even more money getting into criminal hands, unless the technology and telecommunication sectors take [proper] action to stop the fraud that proliferates on their platforms and networks,” Mr Donaldson said.

How to spot and avoid a scam

- Do some research on the company you are buying from and only purchase tickets from the venue, the promoter (such as Live Nation), an official agent (such as Ticketmaster) or a well-known and reputable ticket exchange site

- Search engines such as Google are not always the best place to look, as unauthorised ticket resellers can buy their way to the top of listings with ads

- Look out for the STAR logo – that means the vendor is a member of Society of Ticket Agents and Retailers and signals company has signed up to strict governing standards

- Avoid paying for tickets by bank transfer, especially if buying from someone unknown. Credit card or payment services such as PayPal give you a better chance of recovering the money if you become a victim of fraud

- Be wary of unsolicited emails, texts or adverts offering unbelievably good deals on tickets – it is more than likely that such offers are too good to be true